2013

Governments need money. They can impose taxes to get it, but people don’t like that. But there’s a more subtle way to siphon off wealth from producers. It’s called monetary inflation. In the 20th century, money for the first time in history became unhinged from commodities like gold and silver.

Commodity Money

Historically, commodity money evolved through traders’ choices. Commodities suitable for money must be liquid (easily sellable), and are selected according to durability, uniformity of quality, high unit value, stable supply, and utility outside monetary value. After centuries, international and wide-area markets generally settled on gold or silver as the basis of their money. A certain weight of gold (or silver) became, by the practice and custom of traders, the unit of exchange.

A major advantage of commodity money is that (if it satisfies the stable supply criteria) it cannot be inflated or deflated easily. When the US was on a semi-gold-standard in the 19th century consumer prices declined about 3%. With a commodity standard, technological advancement should cause slight deflation over time - a good thing for consumers. Specie (precious metal) based money can only be created by mining new metal, with yearly output small compared to the existing supply. Commodity money is not very susceptible to political manipulation since its supply and value are largely independent of government action.

Fiat Money

Commodity money is carried in coin or paper warehouse receipts. Fiat money is not a warehouse receipt. It gets its value by decree of State, i.e. fiat. Most modern money - money issued by a government - is fiat money. The world was diverted from the gold/silver commodity standard in the 1900s. For the first time ever, the world monetary standard was fiat money - the US dollar.

The fiat money standard allows governments to monopolize the monetary system, giving it a source of income by plundering the general population through a process called monetary inflation. If the government can create money out of thin air, it becomes too powerful. The devastating wars of the 20th century were funded by fiat money. The imperialism of the US and earlier Britain were funded by fiat money in the form of central banking and fractional reserves.

What is Inflation?

Inflation, also called monetary inflation, is an expansion of the money supply relative to the supply of goods and services. Imagine a stable productive economy in Ruritania with a total of 1000 bingbongs in currency buying and selling all goods. Now suppose someone, a counterfeiter or the government, doubled the number of bingbongs overnight, perhaps dropping bingbong notes from helicopters to distribute them to people.

What happens to prices for goods and services? Basically, you have twice as many bingbongs chasing the same amount of goods, so the prices will be bid up to roughly twice what they were before. Similarly, if the government increases the money supply by 10%, roughly speaking consumer prices will go up by about that much.

The result is that the money-printers have stolen half the buying power of Ruritania. It important to realize that not all Ruritanians come out equally worse off. Some may even benefit. Early receivers of new money enjoy an advantage in buying power over later receivers. So very early receivers, by buying durable property before the prices are bid up due to the inflation, can come out quite well. Generally the early receivers are politically connected corporations and special interests, e.g. munitions firms.

So besides raising prices, the inflation has caused a redistribution of wealth - a redistribution in the worst possible direction. Last but not least, inflation causes business cycles, with all the attending evils and waste. How? Prices go up due to inflation of the money supply. Before the inflation is recognized, entrepreneurs take higher prices as a signal to do more, to ramp up production - that customers are demanding their product. So they invest in capital goods and inputs. Then as the inflation becomes obvious, it turns out that people didn’t like the product that much after all. His extra widget-makers are scrap, maybe he can sell some inputs at cut rates. Inflation tricks entrepreneurs into making bad investments. Recession is simply the period of selling off the bad investments and recovering from the error.

How Do Governments Create Money?

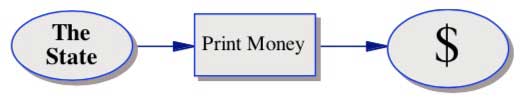

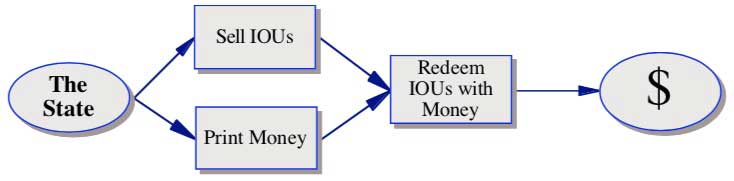

Here is the simplest model of how “the State” (i.e. compulsory government) creates money:

where the last “$” stage is distribution to money users. In this scenario, the government presumably distributes newly-printed currency (or digital credits) to pay its debts, pay salaries, pay for government projects, military bases, ships, weapons, occupations of foreign lands, or whatever. The State likes fiat money because it is so much easier and more lucrative than taxation.

Of course some rulers used this simple print it and spend it plan when they could get away with it. It’s it ideal scam for a ruler. The painless plunder of inflation - it can’t get much better than that for the political elite. But the evolution of the modern State led to another model. It so happens that the political elite and the ultra-wealthy, especially bankers, can use each other’s services to maintain and grow their power and wealth. They are a natural coalition.

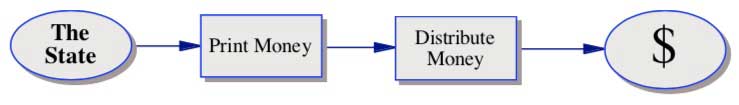

The counterfeiter says to the fence, “I’ll print them, you distribute them.” If the fence gets arrested, the counterfeiter is not directly connected to the fencing operation. This division of labor - print and distribute - has advantages to the plunder operation. Both printer and fence get a cut of the action. A government says to its central bank, “I’ll print them, and you get a monopoly on distributing them.” The government gets free money “out of thin air.”

The central bank distributes the money to subordinate banks, which in turn distributes it to people. Due to fractional reserve banking, at each stage of the way the banks get a cut of the inflation action.

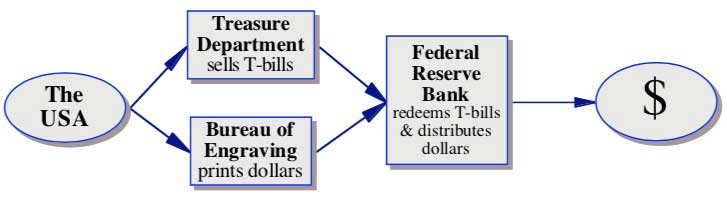

However, governments like to maintain an aura of legitimacy. The diagram above might be seen as morally no different than counterfeiting, even by subjects unfamiliar with commodity money. Constitutional governments strive to pretend that they limit themselves accordingly. While constitutions don’t generally give States the power to create fiat money, they generally do give the power to borrow. Modern governments write IOUs - borrow money. These IOUs are essentially promises to create money in the future. This adds a stage to the process, selling these IOUs. In this scheme, the central bank distributes the new money by paying off the IOUs.

This is the predominant arrangement for states today. There are different names for the IOUs. In the United States the original selling of IOUs is done by the Treasury Department. The Bureau of Engraving, a sub-department of Treasury, prints the money. Of course, a large percentage of the new money is distributed digitally.

Governments are universally prone to inflation, as it is the most subtle, painless, and effective way to extract wealth from productive people. From a rulers’ point of view, it captures wealth now with all the ill effects long delayed, well dispersed, and plausibly denied. Fiat money makes inflation possible; government fiat money makes inflation inevitable.

For a concise history of money in the US, see What Has Government Done to Our Money by Murray Rothbard. This is available online at http://mises.org/money.asp.