The Ideal Cryptocurrency

Unbacked crypto dominates fiat currency, and backed crypto dominates unbacked crypto.

I agree with Coin Bureau’s analysis of fiat currency - that bitcoin has all the good qualities of fiat, but is better than fiat since it can’t be inflated, etc. But a decentralized backed cryptocurrency (where people can issue currency in any commodity, not just gold and silver but in the future maybe kilowatt hours) has all the good properties of unbacked cryptocurrency like bitcoin, but is better than unbacked since it is redeemable in a real commodity. By real commodity, I mean matter-energy, today meaning a physical commodity, and not merely a virtual commodity. In my opinion, backed crypto would kill unbacked crypto in a freed market.

There is a catch. When we talk about decentralized blockchain tech, we are usually talking about decentralized blockchain block verification and redundant storage. With backed crypto, the ideal would also have to include decentralized “vaults” for the commodity. The main pushback I get from Bitcoin enthusiasts is that some don’t understand how a vault can possibly be decentralized. I see it being done through (for lack of a better term) trustline technology, that is, the lines of trust developed by Ripple and also used by Stellar, leveraging the “six degrees of separation” phenomena. Everyone is their own bank, and settles as necessary with people he has given a line of trust.

That is the ideal. I suspect that private centralized networks may win out in the market. E.g. If Apple and Walmart came out with iSilver that could be redeemed for Silver Sam 1 oz. silver rounds at any Walmart … I’m sure something like that is in the corporate disaster recovery plans for when the dollar hyperinflates. Firms just wanna get paid!

A comparison of currency backing types is shown here.

Notice that a free commodity standard, rather than a gold standard, finesses Coin Bureau’s objections to gold. E.g. If an amazing new discovery (e.g. a gold asteroid) in one commodity makes it unsatisfactory, people will simply switch to another monetary commodity.

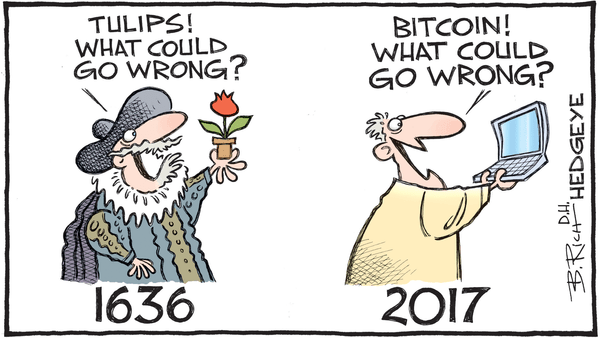

The main problem with unbacked cryptocurrencies like Bitcoin is that it is not a store of value. I have heard bitcoin fans claim that it is, but they use vacuous reasoning: that a bitcoin will always be worth a bitcoin. Yeah, and the same could be said for tulips. Bitcoin and other unbacked cryptocurrencies are speculative assets, pretty much the opposite of a store of value.

These comments were motivated by the Coin Bureau video Don't Buy Gold!! Here's Why!.

Money

Money